What does Mineral Processing Project Financing Involve?

Mineral processing project financing involves raising capital to fund the development and operation of mineral processing projects.

This can include funding for exploration, mine development, equipment purchase, construction, and operational expenses.

One common way to finance mineral processing projects is through debt financing, where the project developers borrow money from banks or other financial institutions. The loan is typically secured by the mineral assets, which serve as collateral for the loan.

Equity financing is another option, where investors provide capital in exchange for ownership in the project. This can be in the form of shares or other securities. Private equity firms, venture capitalists, and strategic investors are all potential sources of equity financing.

Control of capital in mineral processing projects is critical to ensure that funds are used efficiently and effectively. Project managers must carefully track and manage expenses to ensure that they remain within budget. They must also monitor progress against milestones and adjust plans as needed to ensure that the project stays on track.

Effective control of capital also requires effective risk management. Mineral processing projects are often complex and involve a high degree of uncertainty. Project managers must identify and assess risks and put in place measures to mitigate them. This can include developing contingency plans, establishing appropriate insurance coverage, and ensuring that appropriate safety protocols are in place.

Overall, effective project financing and control of capital are essential to the success of mineral processing projects. This requires careful planning, management, and risk mitigation to ensure that the project remains on track and meets its objectives.

What is involved in developing a Project Risk and Analysis Blue Print for Mineral Processing?

Developing a Mineral Processing Plant Capital Risk and Analysis Blueprint involves the following steps:

Define project objectives:

Determine the project's objectives, including the desired production capacity, target markets, and financial goals.

Identify key risks: Identify and evaluate the various types of risks associated with the project, including market risks, technical risks, regulatory risks, financial risks, social risks, design and engineering risks, equipment selection and procurement risks, and construction and commissioning risks.

Develop risk mitigation strategies: Develop risk mitigation strategies to address each of the identified risks. This may involve developing contingency plans, incorporating risk management processes into project planning, and engaging with stakeholders to address social and regulatory risks.

Conduct financial analysis: Conduct a comprehensive financial analysis that includes cash flow projections, break-even analysis, return on investment analysis, and sensitivity analysis to identify key financial risks and opportunities.

Develop project financing plan: Develop a project financing plan that considers the financing options available, including equity financing, debt financing, and government financing.

Develop project management plan: Develop a project management plan that includes clear project milestones, timelines, and monitoring and reporting processes.

Develop ESG plan: Develop an ESG plan that outlines the project's social and environmental impact, mitigation measures, and engagement with stakeholders.

Implement the plan: Implement the plan, including risk mitigation strategies, financial analysis, project financing, project management, and ESG plans.

Monitor and evaluate: Monitor and evaluate the project's performance regularly to ensure that it is meeting its objectives and to identify any potential risks or opportunities.

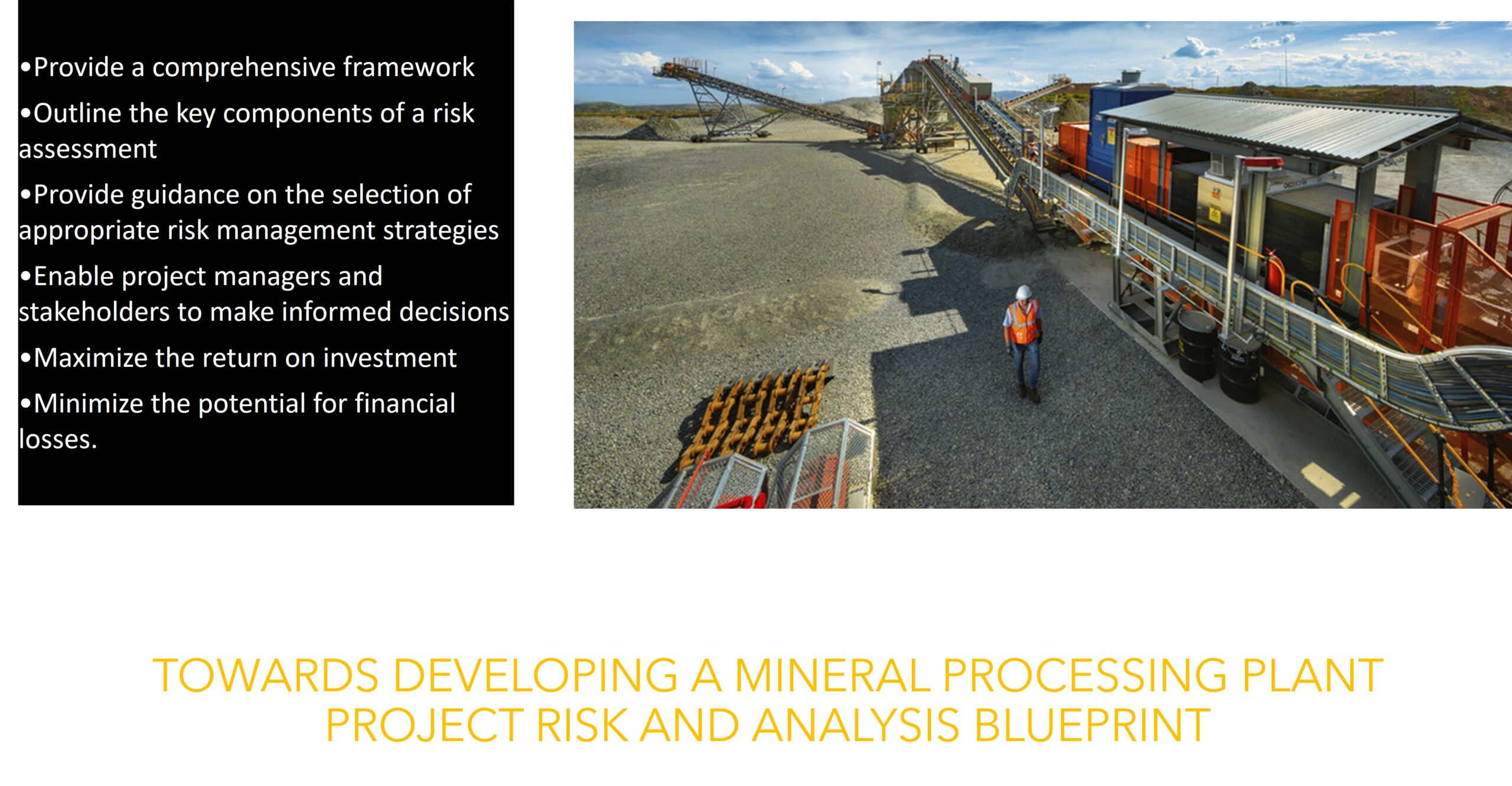

What are the objectives for Project Capital Risk and Analysis?

The objective of developing a Mineral Processing Plant capital risk and analysis blueprint is to :

Provide a comprehensive framework for identifying, analyzing, and mitigating risks associated with capital projects in the mineral processing industry

Outline the key components of a risk assessment process for mineral processing capital projects

Provide guidance on the selection of appropriate risk management strategies for mineral processing capital projects

Enable project managers and stakeholders to make informed decisions about project financing, design, construction, and operation

Maximize the return on investment for mineral processing capital projects

Minimize the potential for financial losses and other negative outcomes in mineral processing capital projects.

What are the Risks associated with Capital Project Financing and Comtrol?

There are several risks associated with project capital financing and control in mineral processing projects, including:

Financial risk: Mineral processing projects often require significant upfront capital investments, which can put a strain on the project's finances. This risk can be compounded by fluctuations in commodity prices, changes in interest rates, and other economic factors that can impact project revenues and cash flows.

Operational risk: Mineral processing projects are complex and involve a variety of operational risks, such as equipment breakdowns, supply chain disruptions, and labor shortages. These risks can lead to delays and cost overruns that can impact the project's financial performance.

Regulatory risk: Mineral processing projects are subject to a range of regulatory requirements, including environmental regulations, labor laws, and permitting requirements. Non-compliance with these regulations can result in fines, project delays, and reputational damage.

Market risk: The success of mineral processing projects is often tied to market conditions, including supply and demand dynamics, competitor activity, and global economic trends. Changes in these factors can impact the project's profitability and financial performance.

Political risk: Mineral processing projects can be affected by political instability, including changes in government policies, social unrest, and geopolitical tensions. These risks can impact the project's ability to obtain financing, secure permits, and access critical resources.

Effective risk management strategies can help mitigate these risks and improve the project's chances of success. This can include implementing robust financial controls, developing contingency plans, monitoring market and political conditions, and engaging with stakeholders to address regulatory and operational risks.

What are the risk Mitigating Strategies that can be Applied?

There are several methods that can be applied to mitigate project financing risk in mineral processing projects. These include:

Diversification: One way to reduce financing risk is to diversify the sources of funding. This can include accessing multiple debt and equity markets, as well as engaging with a range of investors and lenders.

Risk sharing: Sharing project risks with partners or investors can help reduce the overall financing risk. This can involve forming joint ventures, strategic partnerships, or other collaborative arrangements.

Hedging: Hedging can be used to reduce the impact of market risks, such as commodity price volatility or foreign exchange fluctuations. This can involve using financial instruments such as futures, options, or swaps to manage exposure to these risks.

Contingency planning: Developing contingency plans can help mitigate the impact of operational or financial risks. This can involve setting aside reserves or establishing contingency funds to cover unexpected costs or delays.

Project finance structuring: Proper structuring of the project finance can also help to mitigate financing risks. This can include using appropriate debt-to-equity ratios, establishing appropriate covenants, and choosing the most appropriate financing instruments.

I

nsurance: Obtaining appropriate insurance coverage can help mitigate risks associated with events such as natural disasters, accidents, or other unforeseen circumstances. This can include property insurance, liability insurance, and other types of risk coverage.

Overall, effective risk management strategies can help mitigate project financing risk and improve the chances of project success. By taking a proactive and comprehensive approach to risk management, project managers can ensure that the project remains on track and meets its objectives.

What are the risks associated with Mineral Processing Capital Projects?

There are several risks associated with capital projects in mineral processing. Some of the key risks include:

Market risk: Commodity prices can be volatile and are subject to global supply and demand dynamics, geopolitical events, and macroeconomic factors. Market risk can affect the profitability of mineral processing projects.

Technical risk: Mineral processing projects involve complex processing technologies, and there is a risk that these technologies may not perform as expected, leading to delays and cost overruns.

Operational risk: Mining and mineral processing projects often take place in remote locations with challenging environmental conditions. There is a risk of equipment failure, supply chain disruptions, or unexpected weather events that could impact project timelines and costs.

Regulatory risk: Mineral processing projects are subject to numerous regulatory requirements related to health and safety, environmental protection, and community engagement.

Non-compliance with these regulations could result in penalties, fines, or legal disputes.

Financial risk: Capital projects in mineral processing require significant upfront investment, and there is a risk that project costs may exceed budgeted amounts. In addition, interest rate fluctuations, currency exchange rate fluctuations, and other financial risks can affect project profitability.

Social risk: Mining and mineral processing projects can have significant social impacts, including the displacement of local communities, damage to cultural heritage sites, and negative impacts on water and air quality. Failure to effectively manage these social risks can lead to reputational damage and project delays.

It is important to conduct a comprehensive risk assessment and develop effective risk management strategies to mitigate these risks and improve the likelihood of project success in mineral processing capital projects.

What are the Market Risk Factors?

Market risk is a significant risk factor for mineral processing capital projects. Mineral prices can be volatile and are subject to global supply and demand dynamics, geopolitical events, and macroeconomic factors.

Mineral prices can be influenced by factors such as changes in global demand, supply disruptions, fluctuations in currency exchange rates, and changes in government policies and regulations.

Market risk can have a significant impact on the profitability of mineral processing capital projects. For example, if the price of the mineral being processed falls below the project's break-even point, the project may become unprofitable.

Conversely, if the price of the mineral increases, the project's profitability may be enhanced.

Effective market risk management strategies can help to mitigate the impact of market risk on mineral processing capital projects. One such strategy is hedging, which involves taking positions in financial instruments that offset potential losses from adverse market movements.

Hedging strategies can include using futures contracts, options, or other financial derivatives.

Another strategy is diversification, which involves investing in multiple mineral processing projects or in different mineral commodities to spread the risk across a portfolio. This can help to reduce the impact of market volatility on individual projects.

Overall, market risk is an important consideration in mineral processing capital projects, and effective market risk management strategies can help to improve project profitability and reduce the impact of adverse market movements.

What are the technical Risk factors?

Technical risks are a significant concern when it comes to mineral processing capital projects. Mineral processing projects require complex processing technologies, and there is a risk that these technologies may not perform as expected, leading to delays and cost overruns.

Some of the key technical risks associated with mineral processing capital projects include:

Design and engineering risks: The design and engineering of a mineral processing plant is a complex process that involves a range of technical disciplines. Errors or oversights in the design process can lead to equipment failure, production bottlenecks, and costly rework.

Technology risks: Mineral processing projects often rely on specialized processing technologies, such as flotation or leaching processes. There is a risk that these technologies may not perform as expected, leading to reduced recoveries or lower quality products.

Equipment selection and procurement risks: Mineral processing plants require a range of specialized equipment, including crushers, mills, flotation cells, and thickeners. There is a risk that equipment selection may not be optimal, leading to lower than expected productivity or higher operating costs.

Construction and commissioning risks: Mineral processing projects require extensive construction and commissioning activities. There is a risk of delays or cost overruns during construction, which can impact the overall project schedule and budget.

Operational risks: Once a mineral processing plant is operational, there is a risk of equipment failure, supply chain disruptions, or unexpected weather events that could impact production and operating costs.

Effective technical risk management strategies can help to mitigate these risks and improve the likelihood of project success in mineral processing capital projects. This can include conducting detailed feasibility studies and technical reviews, working with experienced equipment suppliers and contractors, and implementing robust quality control and testing procedures during construction and commissioning.

What are the Operational Risk Factors?

Operational risk factors are a significant concern when it comes to mineral processing capital projects. Once a mineral processing plant is operational, there are a number of operational risks that can impact the plant's efficiency, productivity, and profitability. Some of the key operational risk factors in mineral processing projects include:

Equipment failure: Equipment failure is a major operational risk factor in mineral processing plants. If key equipment, such as crushers, mills, or conveyors, fails, this can cause unplanned downtime, which can have significant financial implications.

Supply chain disruptions: Mineral processing plants rely on a range of suppliers to provide critical materials and equipment. Supply chain disruptions, such as delays in material delivery or quality issues with equipment, can impact plant operations and lead to delays and cost overruns.

Human error: Human error can also be a significant operational risk factor in mineral processing projects. Mistakes made during plant operation, maintenance, or repair can lead to equipment failure, unplanned downtime, and safety incidents.

Environmental and safety risks: Mineral processing plants can have significant environmental and safety risks. For example, the use of chemicals in processing can lead to environmental contamination, while accidents involving heavy equipment or handling of hazardous materials can pose safety risks to plant workers.

Weather events and natural disasters: Mineral processing plants can be impacted by weather events and natural disasters, such as floods, hurricanes, or earthquakes. These events can damage equipment and infrastructure, disrupt supply chains, and impact plant operations.

Effective operational risk management strategies can help to mitigate these risks and improve the likelihood of project success in mineral processing projects. This can include implementing robust maintenance and inspection programs, working with reliable suppliers and contractors, investing in safety and environmental protection measures, and developing contingency plans for supply chain disruptions and weather events.

What are the regulatory Risk factors?

Regulatory risk factors are also an important consideration when it comes to mineral processing capital projects. Regulatory requirements can impact all phases of a project, from initial exploration to plant operation, and failure to comply with regulations can have significant financial and reputational consequences. Some of the key regulatory risk factors in mineral processing projects include:

Environmental regulations: Mineral processing projects are subject to a range of environmental regulations, including those related to air and water quality, waste management, and land use. Failure to comply with these regulations can result in fines, penalties, and project delays.

Permitting requirements: Mineral processing projects typically require a range of permits and approvals from government agencies at the local, state, and federal levels. Delays or denials in obtaining these permits can significantly impact project timelines and costs.

Health and safety regulations: Mineral processing projects are subject to health and safety regulations that protect workers and the surrounding community. Failure to comply with these regulations can lead to safety incidents and legal liability.

Land tenure and access: Mineral processing projects often require access to land, either through ownership or lease agreements. Land tenure and access issues can arise due to conflicting land uses, competing interests, or disputes over ownership.

P

olitical and social instability: Mineral processing projects can be impacted by political and social instability, particularly in developing countries. Changes in government policies, civil unrest, and labor disputes can disrupt project timelines and increase project risks.

Effective regulatory risk management strategies can help to mitigate these risks and improve the likelihood of project success in mineral processing projects. This can include engaging with government agencies and local communities early in the project planning process, developing robust compliance programs, and conducting thorough due diligence on land tenure and access issues.

What are the Financial Risk Factors?

Financial risk factors are also a significant consideration when it comes to mineral processing capital projects. These risks can impact project feasibility, profitability, and sustainability. Some of the key financial risk factors in mineral processing projects include:

Capital costs: Mineral processing projects typically require significant upfront capital investment to fund construction, equipment, and infrastructure. Cost overruns or delays can significantly impact project economics and financial viability.

Operating costs: Mineral processing projects also incur ongoing operating costs, including labor, energy, and maintenance. Fluctuations in these costs can impact project profitability.

Price volatility: Mineral prices can be subject to significant volatility due to global economic conditions, supply and demand factors, and geopolitical events. Price declines can impact project revenue and profitability.

Currency risk: Mineral processing projects often involve transactions in multiple currencies, which can be subject to currency fluctuations. This can impact project costs, revenues, and financing.

Financing risk: Mineral processing projects often require significant financing from a range of sources, including banks, investors, and government agencies. Financing risks can include high interest rates, stringent lending requirements, and changes in lending conditions.

Effective financial risk management strategies can help to mitigate these risks and improve the likelihood of project success in mineral processing projects. This can include developing robust financial models, conducting thorough sensitivity analyses, and exploring alternative financing options.

What are the social Risk Factors?

Social risk factors are also an important consideration when it comes to mineral processing capital projects. These risks can arise from potential impacts on local communities, indigenous peoples, and other stakeholders. Some of the key social risk factors in mineral processing projects include:

Community opposition: Mineral processing projects can face opposition from local communities concerned about environmental impacts, loss of livelihoods, and cultural heritage.

Indigenous rights: Mineral processing projects may impact the rights and interests of indigenous peoples who have traditional connections to the land and resources.

Labor rights: Mineral processing projects may face social risk if labor rights are not respected, including fair wages, safe working conditions, and access to training and advancement opportunities.

Health and safety: Mineral processing projects can pose health and safety risks to workers and nearby communities, including exposure to hazardous materials, accidents, and health impacts related to noise and air pollution.

Human rights: Mineral processing projects may impact human rights, including the right to water, food, and a healthy environment, as well as the rights of women, children, and marginalized groups.

Effective social risk management strategies can help to mitigate these risks and improve the likelihood of project success in mineral processing projects. This can include engaging with local communities and other stakeholders to understand their concerns and interests, conducting social impact assessments, and implementing effective grievance mechanisms to address concerns and complaints.

How to Reduce Polital Risk

What are the Design and Engineering Risk factors?

Design and engineering risks are also important to consider in mineral processing capital projects. These risks can arise from potential issues in the design and engineering of the processing plant, which can lead to cost overruns, delays, and potential safety hazards. Some of the key design and engineering risk factors in mineral processing projects include:

Process design: The process design of the mineral processing plant is critical for ensuring efficient and effective extraction of minerals. Poor process design can result in lower yields, increased costs, and lower quality products.

Equipment selection: The selection of equipment for the processing plant is also important, as it can impact the efficiency, capacity, and cost-effectiveness of the plant. Inappropriate equipment selection can lead to operational problems, downtime, and increased maintenance costs.

Site selection: The site selection of the mineral processing plant is critical for ensuring access to resources, infrastructure, and transportation. Poor site selection can result in logistical challenges, increased costs, and potential safety hazards.

Environmental considerations: Mineral processing plants can have significant impacts on the environment, including air and water pollution, habitat destruction, and resource depletion. Effective environmental management and compliance with regulations is essential for minimizing these impacts.

Safety considerations: Mineral processing plants can be hazardous environments, with potential risks to workers and nearby communities. Effective safety management and risk mitigation strategies are critical for ensuring a safe and healthy working environment.

Effective design and engineering strategies can help to mitigate these risks and improve the likelihood of project success in mineral processing projects. This can include engaging with experienced design and engineering firms, conducting comprehensive risk assessments, and implementing effective project management and quality control systems.

What are the Technology Risk factors?

Technology risk factors are also important to consider in mineral processing capital projects. These risks can arise from the use of new or untested technologies or processes, which can lead to cost overruns, delays, and potential safety hazards. Some of the key technology risk factors in mineral processing projects include:

Reliability of new technologies: The use of new or untested technologies can introduce potential reliability risks, which can lead to operational problems, downtime, and increased maintenance costs.

Compatibility of new technologies: The compatibility of new technologies with existing equipment, processes, and systems is critical for ensuring efficient and effective operation of the processing plant. Poor compatibility can result in inefficiencies, increased costs, and potential safety hazards.

Complexity of new technologies: New technologies can be complex and require specialized knowledge and expertise for proper installation and operation. Lack of understanding or improper implementation can lead to operational problems, safety hazards, and increased costs.

Availability of new technologies: The availability of new technologies and equipment can impact project schedules and budgets. Long lead times or delays in procurement can result in project delays and increased costs.

Training and skill requirements: The use of new technologies and equipment can require specialized training and skills for proper operation and maintenance. Lack of training or skill shortages can result in safety hazards, inefficiencies, and increased costs.

Effective technology management and risk mitigation strategies are critical for minimizing these risks and improving the likelihood of project success in mineral processing projects. This can include conducting comprehensive technology assessments, engaging with experienced technology providers and consultants, and implementing effective training and knowledge management systems.

What are the Equipment Selection and Procurement Risk factors?

Equipment selection and procurement risk is another important factor to consider in mineral processing capital projects. This risk can arise from a range of issues related to the selection, procurement, and installation of equipment, including:

Availability of equipment: The availability of equipment can impact project schedules and budgets. Long lead times or delays in procurement can result in project delays and increased costs.

Equipment performance: The performance of equipment can impact the efficiency and effectiveness of the processing plant. Poor performance can result in inefficiencies, increased costs, and potential safety hazards.

Equipment compatibility: The compatibility of equipment with existing equipment, processes, and systems is critical for ensuring efficient and effective operation of the processing plant. Poor compatibility can result in inefficiencies, increased costs, and potential safety hazards.

Equipment installation and commissioning: Improper installation and commissioning of equipment can lead to operational problems, safety hazards, and increased costs. This risk can be mitigated through effective project management and quality assurance processes.

Equipment maintenance and repair: The maintenance and repair of equipment is critical for ensuring long-term reliability and performance. Inadequate maintenance or repair can lead to operational problems, downtime, and increased costs.

Effective equipment management and risk mitigation strategies are critical for minimizing these risks and improving the likelihood of project success in mineral processing projects. This can include conducting comprehensive equipment assessments, engaging with experienced equipment providers and consultants, implementing effective maintenance and repair programs, and implementing effective project management and quality assurance processes.

What are the Construction and Commissioning Risk factors?

Construction and commissioning risk factors are also important to consider in mineral processing capital projects. These risks can arise from a range of issues related to the construction and commissioning phases of the project, including:

Construction delays: Delays in construction can impact project schedules and budgets. This can be caused by a range of factors, including labor shortages, adverse weather conditions, or unforeseen technical issues.

Cost overruns: Construction and commissioning costs can often exceed budgeted amounts, resulting in cost overruns that impact project viability and profitability.

Safety hazards: The construction and commissioning phases of a project can pose significant safety risks for workers and the surrounding environment. Effective safety management and risk mitigation strategies are critical for minimizing these risks.

Commissioning issues: Technical issues or other problems can arise during the commissioning phase of a project, which can result in delays, increased costs, and reduced operational efficiency.

Quality assurance: Effective quality assurance processes are critical for ensuring that the project is completed to the required standards and specifications. Poor quality can lead to operational problems, safety hazards, and increased costs.

To mitigate these risks, it is important to engage experienced contractors and consultants with a strong track record of delivering successful mineral processing projects.

Effective project management and quality assurance processes are also critical for minimizing risks and ensuring project success. This can include implementing effective safety management systems, conducting regular project reviews and risk assessments, and implementing quality control and quality assurance programs throughout the project lifecycle.

Environmental Impact of Mining

What are the Operational Risk Factors?

Operational risk factors are important to consider in mineral processing capital projects, as they can have a significant impact on the long-term viability and profitability of the project. Some common operational risk factors include:

Process and equipment performance: The performance of the processing plant and associated equipment is critical for ensuring the efficient production of mineral products. Issues with equipment reliability, maintenance, and downtime can result in reduced production, increased costs, and decreased profitability.

Supply chain disruptions: Mineral processing projects rely on a range of inputs, including raw materials, equipment, and energy. Any disruptions to the supply chain, such as material shortages or delivery delays, can impact project schedules, costs, and profitability.

Market demand and pricing: The demand for mineral products can fluctuate based on a range of factors, including global economic conditions and market trends. Fluctuations in market demand and pricing can impact project profitability, and effective market analysis and forecasting is critical for mitigating these risks.

Regulatory compliance: Mineral processing projects are subject to a range of regulatory requirements, including environmental regulations, health and safety standards, and permitting requirements. Failure to comply with these requirements can result in fines, legal action, and reputational damage.

Human capital: The success of a mineral processing project also depends on the quality and availability of human resources, including skilled labor, management, and technical expertise. Challenges with recruiting, training, and retaining staff can impact project schedules, costs, and overall project success.

To mitigate operational risks, effective project management and process optimization are critical. This can include implementing proactive maintenance and reliability programs, developing contingency plans for supply chain disruptions, conducting regular market analysis and forecasting, and ensuring compliance with regulatory requirements.

Effective human resource management and training programs are also critical for building a skilled and experienced workforce.

Impact of Mining on Water quality

What are the elements of a successful Mineral Processing Project finance?

The elements of a successful mineral processing project finance may include:

Comprehensive feasibility study: A detailed feasibility study that covers all aspects of the project is crucial. This includes market analysis, resource estimation, process design, engineering, and financial analysis.

Experienced project team: A team of experienced professionals with knowledge of the mineral processing industry, including geologists, engineers, and financiers, can help mitigate risk and ensure project success.

Strong partnership with lenders and investors: Developing strong relationships with lenders and investors is essential for securing project financing.

Effective risk management: Identifying and managing risks associated with the project is crucial to ensure that the project remains financially viable.

Effective project management: Effective project management, including clear project planning, scheduling, and monitoring, can help ensure that the project is delivered on time and within budget.

Efficient plant design and operation: Efficient plant design and operation can help minimize costs and increase profitability.

Strong ESG (environmental, social, and governance) performance: Maintaining strong ESG performance can help ensure that the project receives social and regulatory support, which is essential for successful project finance.

Strong market demand: A strong market demand for the mineral product can help ensure long-term profitability and return on investment.

What is the Industry Trends and Best Practice Related to Project Risk and analysis?

The mineral processing industry is highly cyclical and subject to a variety of risks, including changes in commodity prices, regulatory and environmental risks, and operational risks such as equipment failure or supply chain disruptions. As a result, project capital risk analysis is a critical component of mineral processing plant financing and project management.

Industry trends and best practices for project capital risk analysis in mineral processing plants include:

Comprehensive risk assessment: A thorough risk assessment should be conducted at the outset of the project to identify and evaluate all potential risks, including market, financial, operational, and technical risks. This should involve the use of financial modeling techniques such as scenario analysis and sensitivity analysis.

Robust financial modeling: Financial modeling is a key tool for analyzing project capital risk in mineral processing plants. The model should be based on sound assumptions and incorporate all relevant data, including historical financial data, market trends, and operational metrics.

Sensitivity analysis should be used to test the model's sensitivity to changes in key assumptions.

Risk mitigation strategies: Mitigation strategies should be developed and incorporated into the project plan to minimize the impact of potential risks. These may include contingency plans for equipment failure, supply chain disruptions, or regulatory changes.

Regular monitoring and reporting: Regular monitoring and reporting on project performance is critical to identifying potential risks and taking corrective action before they become significant problems. This may include regular financial reporting, site inspections, and project review meetings.

Stakeholder engagement: Engaging with stakeholders, including investors, lenders, and regulatory bodies, is essential to ensuring that project capital risk is properly understood and managed. Stakeholders should be kept informed of project progress and any changes to the risk profile.

Overall, the key to effective project capital risk analysis in mineral processing plants is to adopt a comprehensive and proactive approach that incorporates financial modeling, risk mitigation strategies, and regular monitoring and reporting. By doing so, investors and project managers can minimize the impact of potential risks and improve the likelihood of project success.

What processes and tools are available for Mineral Processing Project Financial Analysis?

Financial analysis is a critical component of mineral processing project finance. Some of the financial analysis that can be carried out for mineral processing project finance include:

Financial modeling: Financial modeling involves creating a detailed financial plan that estimates the cash flows, profits, and returns on investment of the project. This can help identify potential financial risks and opportunities and inform financing decisions.

Sensitivity analysis: Sensitivity analysis involves examining the potential impact of changes in key project variables, such as commodity prices, interest rates, or production costs, on project profitability. This can help identify the most significant risks and inform risk mitigation strategies.

Capital budgeting: Capital budgeting involves evaluating the investment opportunities associated with the project, including the cost of capital, the expected return on investment, and the payback period. This can help inform financing decisions and prioritize investment opportunities.

Ratio analysis: Ratio analysis involves examining key financial ratios, such as debt-to-equity ratio, return on equity, and net present value. This can help evaluate the financial health of the project and inform financing decisions.

Cash flow analysis: Cash flow analysis involves examining the project's cash inflows and outflows, including operating costs, capital expenditures, and financing activities. This can help identify potential cash flow issues and inform financing decisions.

Risk analysis: Risk analysis involves evaluating the potential risks associated with the project and developing appropriate risk management strategies. This can help inform financing decisions and reduce the overall financial risk associated with the project.

Overall, financial analysis plays a critical role in mineral processing project finance. By conducting comprehensive financial analysis, project managers can make informed financing decisions and develop effective risk management strategies to ensure project success.

Capital Budgeting and Project Risk

What is Economic Optimisation related to Mineral Processing Capital Project Optimisation?

Economic optimization is an approach used in mineral processing project capital to maximize the financial returns of the project by identifying the optimal mix of inputs, such as capital, labor, and equipment, to achieve the desired output, such as the production of a mineral commodity.

The economic optimization process typically involves several steps, including:

Identifying project objectives: This involves defining the project's goals and identifying the key performance indicators (KPIs) that will be used to measure the project's success.

Developing a production plan: This involves developing a plan to produce the desired output, taking into account the available inputs, such as capital, labor, and equipment.

Conducting economic analysis: This involves analyzing the costs and benefits associated with the production plan, including the cost of inputs, the price of the commodity being produced, and other factors that can impact the project's financial performance.

Sensitivity analysis: This involves examining the potential impact of changes in key variables, such as commodity prices or production costs, on the project's financial performance.

Optimization: This involves identifying the optimal mix of inputs to achieve the desired output while maximizing the project's financial returns.

By using economic optimization, project managers can make informed decisions about how to allocate resources and manage risks to achieve the project's objectives while maximizing financial returns.

This approach can help ensure that the project remains economically viable over the long term and delivers maximum value to stakeholders. n mineral processing capital projects.

What is Accounting Values related to Project Financing?

In project finance, accounting values refer to the financial metrics and indicators that are used to measure the financial performance of the project. These values are used to track the financial progress of the project and to evaluate its financial viability.

Some common accounting values that are used in project finance include:

Gross revenue: This is the total revenue generated by the project before deducting any expenses.

Net revenue: This is the revenue generated by the project after deducting any expenses, including operating costs and capital expenditures.

Operating expenses: These are the expenses incurred in the day-to-day operation of the project, including labor costs, maintenance costs, and other expenses related to running the project.

Capital expenditures: These are the expenses associated with the acquisition of capital assets, such as equipment or property, that are necessary for the project.

Return on investment (ROI): This is a financial ratio that measures the return on investment generated by the project. It is calculated by dividing the net income by the total investment in the project.

Internal rate of return (IRR): This is a financial metric that measures the rate of return generated by the project over its lifetime.

Payback period: This is the amount of time required for the project to generate enough cash flows to pay back the initial investment.

By tracking these accounting values, project managers can evaluate the financial performance of the project and make informed decisions about how to allocate resources and manage risks to ensure the project's long-term financial viability.

What is Accounting representation?

The accounting representation of a project is a financial statement that provides an overview of the financial performance of the project. The accounting representation typically includes a balance sheet, an income statement, and a cash flow statement.

The balance sheet provides a snapshot of the project's financial position at a given point in time. It shows the project's assets, liabilities, and equity. The assets typically include cash, accounts receivable, inventory, and property, plant, and equipment.

The liabilities typically include accounts payable, loans, and other obligations. The equity represents the residual interest in the project after deducting liabilities from assets.

The income statement provides a summary of the project's revenues, expenses, and profits or losses over a given period of time. It shows the project's total revenue, the cost of goods sold, operating expenses, and other income and expenses. The income statement is used to calculate the project's net income or loss.

The cash flow statement provides a summary of the project's cash inflows and outflows over a given period of time. It shows the project's cash receipts, cash payments, and changes in cash balances. The cash flow statement is used to determine the project's net cash flow, which is an important measure of the project's ability to generate cash.

By providing a comprehensive view of the project's financial performance, the accounting representation of the project helps project managers, investors, and other stakeholders make informed decisions about the project's financial viability and sustainability. It also helps to identify areas where the project may be experiencing financial difficulties and to develop strategies to address these issues.

What is Financial Modelling?

Financial modeling is a process of creating a mathematical representation of a company's financial situation or a project's financial performance. It is typically used to forecast future financial outcomes based on different assumptions and scenarios.

Financial modeling involves the use of financial statements, historical data, and other financial information to build a model that can be used to analyze financial performance, evaluate investment opportunities, and make informed decisions about the future.

Financial modeling can be used in a variety of contexts, including project finance, mergers and acquisitions, valuation analysis, and budgeting and forecasting.

The models created can be simple or complex, depending on the scope and purpose of the analysis.

In financial modeling, various financial ratios, metrics and other relevant information are used to create financial statements such as balance sheets, income statements, and cash flow statements.

This process may involve the use of software tools such as Microsoft Excel, MATLAB, or specialized financial modeling software.

The purpose of financial modeling is to provide a quantitative understanding of a company or project's financial performance under different scenarios and assumptions.

By developing and testing different scenarios, financial models help to identify the key drivers of financial performance, quantify the impact of various factors on financial outcomes, and evaluate the financial feasibility of different strategies and investments.

Financial modeling is an important tool for decision-making in finance, accounting, and investment analysis. It helps to improve the accuracy and reliability of financial projections and enables decision makers to make more informed decisions about the future.

Financial Models to Evaluate Capital Projects

What Ratios and Metrics are used in Financial Modelling?

There are many ratios and metrics used in financial modeling. These ratios and metrics are used to analyze a company's financial performance and to make projections about its future financial performance. Here are some common ratios and metrics used in financial modeling:

Profitability ratios: These ratios measure a company's ability to generate profit. Examples include gross profit margin, operating profit margin, and net profit margin.

Liquidity ratios: These ratios measure a company's ability to meet its short-term obligations. Examples include the current ratio and the quick ratio.

Debt ratios: These ratios measure a company's ability to manage debt. Examples include debt-to-equity ratio, debt-to-assets ratio, and interest coverage ratio.

Efficiency ratios: These ratios measure a company's ability to use its assets efficiently. Examples include asset turnover ratio, inventory turnover ratio, and receivables turnover ratio.

Valuation metrics: These metrics are used to estimate the value of a company or investment opportunity. Examples include price-to-earnings ratio, price-to-book ratio, and discounted cash flow analysis.

Cash flow metrics: These metrics measure a company's ability to generate cash flow. Examples include free cash flow, cash conversion cycle, and operating cash flow ratio.

Return on investment (ROI) metrics: These metrics measure the return on investment for a project or investment opportunity. Examples include internal rate of return (IRR), return on investment (ROI), and net present value (NPV).

By using these ratios and metrics in financial modeling, analysts and decision-makers can gain a better understanding of a company's financial performance and make informed decisions about future investments and strategies.

What is Profitability Ratio?

Profitability ratios are financial metrics used to measure a company's ability to generate profit in relation to its revenue, assets, or equity. They provide insight into a company's overall profitability and help investors and analysts assess its financial health and performance.

There are several common profitability ratios used in financial analysis, including:

Gross Profit Margin: This ratio compares a company's gross profit to its revenue and indicates how much profit is left after deducting the cost of goods sold. A higher gross profit margin indicates better profitability.

Operating Profit Margin: This ratio measures a company's operating profit as a percentage of its revenue. It indicates how well a company is managing its expenses and generating profit from its core operations.

Net Profit Margin: This ratio measures a company's net income as a percentage of its revenue. It provides a clear picture of the company's overall profitability, taking into account all expenses and taxes.

Return on Assets (ROA): This ratio measures a company's net income as a percentage of its total assets. It shows how effectively a company is using its assets to generate profit.

Return on Equity (ROE): This ratio measures a company's net income as a percentage of its shareholder equity. It indicates how much profit a company is generating for its shareholders relative to their investment.

Overall, profitability ratios provide insight into a company's ability to generate profit from its operations and are useful in comparing the performance of different companies or assessing changes in a company's financial health over time.

What is Liquidity Ratio?

Liquidity ratios are financial metrics that measure a company's ability to meet its short-term obligations by using its current assets. These ratios provide insight into a company's ability to pay off its debts or cover its expenses in the short term.

There are several common liquidity ratios used in financial analysis, including:

Current Ratio: This ratio measures a company's ability to pay off its short-term liabilities with its current assets. A higher current ratio indicates better liquidity.

Quick Ratio (also known as Acid-Test Ratio): This ratio measures a company's ability to pay off its short-term liabilities with its most liquid assets, such as cash, marketable securities, and accounts receivable.

Cash Ratio: This ratio measures a company's ability to pay off its current liabilities using only its cash and cash equivalents.

Overall, liquidity ratios provide insight into a company's ability to meet its short-term obligations and its overall financial health. They are important indicators for investors, creditors, and other stakeholders when evaluating a company's ability to manage its cash flow and financial risks.

What is Debt Ratio?

The debt ratio is a financial ratio that measures the proportion of a company's total assets that are financed by debt. It is a measure of the extent to which a company is using debt financing to support its operations and investments.

The debt ratio is calculated by dividing the company's total liabilities by its total assets.

The resulting ratio represents the percentage of the company's assets that are financed by debt.

For example, if a company has total liabilities of $500,000 and total assets of $1,000,000, the debt ratio would be 0.5 or 50%.

The debt ratio provides an indication of a company's financial leverage and its ability to meet its debt obligations.

A higher debt ratio indicates that a larger proportion of a company's assets are financed by debt, which can increase financial risk. Conversely, a lower debt ratio indicates that a smaller proportion of a company's assets are financed by debt, which can make the company more stable and less vulnerable to financial distress.

It is important to note that debt ratios vary by industry and company size, so it is important to compare a company's debt ratio to industry benchmarks and peer companies when evaluating its financial health.

What is Efficiency Ratio?

Efficiency ratios are financial metrics that measure how effectively a company is using its assets and liabilities to generate revenue and profits. These ratios provide insight into a company's operational efficiency and its ability to manage its resources effectively.

There are several common efficiency ratios used in financial analysis, including:

Asset Turnover Ratio: This ratio measures a company's ability to generate revenue from its assets. It is calculated by dividing a company's total revenue by its total assets. A higher asset turnover ratio indicates that a company is using its assets more efficiently to generate revenue.

Inventory Turnover Ratio: This ratio measures how quickly a company is selling its inventory. It is calculated by dividing the cost of goods sold by the average inventory value over a specific period. A higher inventory turnover ratio indicates that a company is selling its inventory quickly and efficiently.

Accounts Receivable Turnover Ratio: This ratio measures how quickly a company is collecting its accounts receivable. It is calculated by dividing a company's total credit sales by its average accounts receivable over a specific period. A higher accounts receivable turnover ratio indicates that a company is collecting its accounts receivable quickly and efficiently.

Overall, efficiency ratios provide insight into a company's ability to use its assets and liabilities to generate revenue and profits. They are important indicators for investors, creditors, and other stakeholders when evaluating a company's operational efficiency and financial health.

What are Valuation Metrics?

Valuation metrics are financial ratios and methods used to determine the intrinsic value of a company or asset. These metrics are used by investors, analysts, and other financial professionals to estimate the fair value of a company's stock, assets, or liabilities.

There are several common valuation metrics used in financial analysis, including:

Price-to-Earnings (P/E) Ratio: This ratio measures a company's current stock price relative to its earnings per share (EPS). A higher P/E ratio indicates that investors are willing to pay more for each dollar of earnings, which may indicate a higher growth potential or market expectations for the company.

Price-to-Book (P/B) Ratio: This ratio compares a company's current stock price to its book value (total assets minus liabilities). A higher P/B ratio indicates that investors are willing to pay more for each dollar of the company's book value, which may indicate a higher growth potential or market expectations for the company.

Discounted Cash Flow (DCF) Analysis: This method estimates the intrinsic value of a company or asset by calculating the present value of future cash flows. It involves forecasting the future cash flows of a company or asset and discounting them back to their present value using a discount rate that reflects the risk and opportunity cost of investing in the company or asset.

Overall, valuation metrics provide insight into a company's potential value and are important tools for investors, analysts, and other financial professionals when evaluating investment opportunities.

What is Operating Cash flow?

Cash flow metrics are financial ratios and methods used to measure a company's cash inflows and outflows over a specific period of time. They are important indicators of a company's financial health and its ability to generate cash from its operations, investments, and financing activities.

There are several common cash flow metrics used in financial analysis, including:

Operating Cash Flow Ratio: This ratio measures a company's ability to generate cash from its operations. It is calculated by dividing a company's operating cash flow by its current liabilities. A higher operating cash flow ratio indicates that a company has sufficient cash to cover its short-term liabilities.

Free Cash Flow: This metric measures the amount of cash a company generates after accounting for capital expenditures. It is calculated by subtracting capital expenditures from operating cash flow. A higher free cash flow indicates that a company has more cash available for investments or returning to shareholders.

Cash Conversion Cycle: This metric measures the length of time it takes a company to convert its investments in inventory and accounts receivable into cash. It is calculated by adding the average number of days inventory is held, the average number of days accounts receivable is outstanding, and subtracting the average number of days accounts payable is outstanding. A shorter cash conversion cycle indicates that a company is able to generate cash more quickly.

Overall, cash flow metrics provide insight into a company's ability to generate and manage cash, and are important tools for investors, analysts, and other financial professionals when evaluating a company's financial health and investment potential.

What is Return on Investment?

Return on Investment (ROI) metrics are financial ratios used to measure the profitability of an investment relative to its cost. It is a popular metric used by investors and businesses to evaluate the efficiency and effectiveness of their investments.

The most common ROI metric is calculated by dividing the net profit generated by the investment by the cost of the investment.

The formula for ROI is as follows:

ROI = (Net Profit / Cost of Investment) x 100%

Net profit is calculated by subtracting the cost of the investment from the revenue generated by the investment.

The cost of the investment includes all expenses related to the investment, such as equipment, labor, and marketing.

ROI can be calculated for individual investments, as well as for an entire portfolio of investments. It is an important metric for businesses to evaluate the return on their investments, and to determine which investments are generating the highest returns.

However, it is important to note that ROI should not be the only metric used to evaluate investments, as it does not take into account the time value of money, and may not reflect the risk associated with the investment. Other metrics, such as the net present value (NPV) and internal rate of return (IRR), should also be considered when evaluating investment opportunities.

What is Internal Rate of Return?

Internal rate of return (IRR) is a financial metric used to evaluate the profitability of an investment. It is the rate at which the net present value (NPV) of an investment equals zero. In other words, it is the discount rate that makes the present value of the investment's cash inflows equal to the present value of its cash outflows.

The IRR is commonly used in capital budgeting to evaluate the potential profitability of a project or investment. The higher the IRR, the more profitable the investment is considered to be.

To calculate the IRR of an investment, you must first estimate the cash flows that the investment is expected to generate over its lifetime, and the initial investment required.

Then, using a financial calculator or spreadsheet software, you can calculate the IRR using the following formula:

NPV = 0 = CF0 + CF1/(1+IRR)^1 + CF2/(1+IRR)^2 + ... + CFn/(1+IRR)^n

Where:

NPV is the net present value of the investment

CF0 is the initial cash outflow (usually negative)

CF1 to CFn are the expected cash inflows over the life of the investment

n is the number of periods over which the cash flows occur

IRR is the internal rate of return

NPV = 0 = CF0 + CF1/(1+IRR)^1 + CF2/(1+IRR)^2 + ... + CFn/(1+IRR)^n

Where:

NPV is the net present value of the investment

CF0 is the initial cash outflow (usually negative)

CF1 to CFn are the expected cash inflows over the life of the investment

n is the number of periods over which the cash flows occur

IRR is the internal rate of return

By solving for IRR, you can determine the rate at which the investment's cash inflows equal its cash outflows, and therefore the rate at which the investment is considered to be profitable.

Overall, IRR is a useful metric for evaluating the potential profitability of an investment, but it should be used in conjunction with other financial metrics and analysis to make informed investment decisions.

What is Discounted Cash Flow?

Discounted cash flow (DCF) is a financial analysis method used in capital financing to estimate the present value of future cash flows associated with a project or investment opportunity.

The DCF method is based on the principle that a dollar received today is worth more than a dollar received in the future, because of the time value of money.

The DCF method involves estimating the expected cash flows associated with the project over a specified period of time, and then discounting these cash flows back to their present value using a discount rate that reflects the cost of capital or the required rate of return for the project.

The steps involved in the DCF analysis include:

Estimating the expected cash flows associated with the project, including operating cash flows, capital expenditures, and financing activities.

Determining the discount rate, which is typically based on the cost of capital or the required rate of return for the project.

Discounting the expected cash flows back to their present value using the discount rate.

Calculating the net present value (NPV) of the expected cash flows, which is the difference between the present value of the cash inflows and the present value of the cash outflows.

Interpreting the results of the analysis to make informed decisions about the project or investment opportunity.

The DCF method is widely used in capital financing to evaluate investment opportunities and assess the financial viability of projects. By estimating the present value of future cash flows, the DCF method provides a useful framework for evaluating the long-term financial performance of a project and assessing its potential for generating returns.

Discounted Cash Flow Method

What is Payback?

Payback is a financial metric used to determine the length of time it takes to recoup the initial investment in a project or investment. It is the amount of time required for the total cash inflows from an investment to equal the initial cash outflow.

The payback period is typically measured in years or months and is used by businesses and investors to assess the risk associated with an investment. The shorter the payback period, the less risky the investment is considered to be.

To calculate the payback period, you first need to estimate the cash inflows that the investment is expected to generate over its lifetime, and the initial investment required. Then, you can use the following formula:

Payback Period = Initial Investment / Annual Cash Inflows

For example, if an investment requires an initial cash outflow of $10,000 and generates annual cash inflows of $2,000, the payback period would be:

Payback Period = $10,000 / $2,000 = 5 years

This means that it would take 5 years for the total cash inflows to equal the initial investment of $10,000.

Payback is a simple and easy-to-understand metric, but it does not take into account the time value of money or the overall profitability of the investment. As a result, it is usually used in conjunction with other financial metrics such as net present value (NPV) or internal rate of return (IRR) to make informed investment decisions.

What is sensivity Analysis?

Sensitivity analysis is a financial modeling technique that evaluates the impact of changes in key variables or assumptions on the outcomes of a financial model or investment decision.

It is used to test the sensitivity of a financial model to changes in specific input parameters, such as interest rates, inflation rates, sales volume, or commodity prices, and to assess the level of risk associated with an investment.

Sensitivity analysis involves adjusting one or more of the input parameters in a financial model and observing the resulting changes in the output variables, such as net present value (NPV), internal rate of return (IRR), payback period, or cash flow. By doing so, analysts can identify which variables have the greatest impact on the investment's performance, and which variables are the most sensitive to changes in market conditions or other external factors.

For example, a sensitivity analysis of a real estate investment might evaluate the impact of changes in interest rates or occupancy rates on the investment's cash flow and overall return.

By adjusting these input parameters and observing the resulting changes in the investment's performance, analysts can assess the level of risk associated with the investment and make more informed investment decisions.

Overall, sensitivity analysis is a valuable tool for evaluating the risk and uncertainty associated with a financial model or investment decision, and can help investors and analysts make more informed decisions based on a range of possible outcomes.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://accounts.binance.info/register-person?ref=IHJUI7TF

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your article helped me a lot, is there any more related content? Thanks!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your article helped me a lot, is there any more related content? Thanks!

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? gate注册奖金

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your article helped me a lot, is there any more related content? Thanks!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

I enjoy the efforts you have put in this, thank you for all the great content.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Heya i am for the primary time here. I found this board and I to find It truly helpful & it helped me out much. I hope to provide something back and help others like you helped me.

Some truly interesting info , well written and loosely user genial.

I think other site proprietors should take this website as an model, very clean and great user genial style and design, as well as the content. You’re an expert in this topic!

whoah this blog is excellent i love studying your posts. Stay up the great paintings! You understand, a lot of people are looking around for this information, you can aid them greatly.

Your article helped me a lot, is there any more related content? Thanks!

Balanceadora

Dispositivos de ajuste: esencial para el operación fluido y eficiente de las maquinarias.

En el ámbito de la tecnología actual, donde la rendimiento y la estabilidad del dispositivo son de máxima importancia, los equipos de equilibrado tienen un tarea crucial. Estos aparatos adaptados están creados para ajustar y estabilizar elementos rotativas, ya sea en dispositivos productiva, transportes de transporte o incluso en equipos hogareños.

Para los especialistas en conservación de sistemas y los profesionales, manejar con aparatos de balanceo es fundamental para garantizar el funcionamiento suave y fiable de cualquier aparato giratorio. Gracias a estas alternativas modernas sofisticadas, es posible limitar considerablemente las oscilaciones, el zumbido y la esfuerzo sobre los cojinetes, aumentando la longevidad de piezas importantes.

Igualmente significativo es el rol que juegan los equipos de calibración en la soporte al cliente. El apoyo especializado y el mantenimiento permanente aplicando estos aparatos permiten dar soluciones de excelente estándar, incrementando la agrado de los compradores.

Para los dueños de proyectos, la inversión en equipos de equilibrado y sensores puede ser esencial para optimizar la eficiencia y eficiencia de sus dispositivos. Esto es sobre todo relevante para los inversores que dirigen medianas y modestas emprendimientos, donde cada aspecto vale.

Además, los dispositivos de ajuste tienen una extensa utilización en el campo de la seguridad y el gestión de nivel. Habilitan localizar probables errores, previniendo reparaciones elevadas y perjuicios a los sistemas. Incluso, los datos generados de estos aparatos pueden emplearse para optimizar procedimientos y aumentar la reconocimiento en motores de investigación.

Las zonas de utilización de los aparatos de equilibrado comprenden múltiples sectores, desde la manufactura de vehículos de dos ruedas hasta el control ambiental. No importa si se considera de extensas manufacturas manufactureras o limitados espacios caseros, los dispositivos de ajuste son fundamentales para garantizar un desempeño productivo y sin fallos.

I really appreciate this post. I¦ve been looking everywhere for this! Thank goodness I found it on Bing. You’ve made my day! Thank you again

Hi my friend! I wish to say that this article is awesome, nice written and include approximately all important infos. I would like to see more posts like this.

I was more than happy to seek out this internet-site.I needed to thanks on your time for this excellent learn!! I positively having fun with each little little bit of it and I have you bookmarked to check out new stuff you weblog post.

It is really a great and helpful piece of info. I am happy that you just shared this helpful info with us. Please keep us up to date like this. Thank you for sharing.

Hmm is anyone else encountering problems with the pictures on this blog loading? I’m trying to figure out if its a problem on my end or if it’s the blog. Any feed-back would be greatly appreciated.

Of course, what a splendid site and educative posts, I definitely will bookmark your website.All the Best!

Wow, incredible blog layout! How long have you been blogging for? you make blogging look easy. The overall look of your website is great, as well as the content!

That is the best blog for anybody who needs to find out about this topic. You notice so much its virtually arduous to argue with you (not that I really would need…HaHa). You positively put a new spin on a topic thats been written about for years. Great stuff, just nice!

Your place is valueble for me. Thanks!…

I really like your writing style, great info, regards for posting :D. “Inquiry is fatal to certainty.” by Will Durant.

I am continually searching online for tips that can assist me. Thx!

Your style is so unique compared to many other people. Thank you for publishing when you have the opportunity,Guess I will just make this bookmarked.2

Hello, i read your blog from time to time and i own a similar one and i was just curious if you get a lot of spam comments? If so how do you prevent it, any plugin or anything you can recommend? I get so much lately it’s driving me insane so any help is very much appreciated.

Amazing blog! Do you have any hints for aspiring writers? I’m hoping to start my own website soon but I’m a little lost on everything. Would you suggest starting with a free platform like WordPress or go for a paid option? There are so many options out there that I’m totally overwhelmed .. Any recommendations? Appreciate it!

Greetings from Florida! I’m bored to tears at work so I decided to browse your site on my iphone during lunch break. I really like the info you provide here and can’t wait to take a look when I get home. I’m amazed at how quick your blog loaded on my phone .. I’m not even using WIFI, just 3G .. Anyhow, wonderful site!

I’ve recently started a website, the information you provide on this website has helped me greatly. Thanks for all of your time & work.

naturally like your web site but you need to check the spelling on several of your posts. A number of them are rife with spelling problems and I find it very bothersome to tell the truth nevertheless I will surely come back again.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Super-Duper site! I am loving it!! Will be back later to read some more. I am bookmarking your feeds also

Woh I like your content, saved to favorites! .

Your article helped me a lot, is there any more related content? Thanks!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Normally I don’t learn post on blogs, but I wish to say that this write-up very forced me to check out and do so! Your writing taste has been amazed me. Thank you, quite nice article.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thanx for the effort, keep up the good work Great work, I am going to start a small Blog Engine course work using your site I hope you enjoy blogging with the popular BlogEngine.net.Thethoughts you express are really awesome. Hope you will right some more posts.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

I like what you guys are up also. Such clever work and reporting! Keep up the excellent works guys I have incorporated you guys to my blogroll. I think it’ll improve the value of my website 🙂

Pretty! This was a really wonderful post. Thank you for your provided information.

I have been surfing online more than three hours nowadays, but I never found any fascinating article like yours. It is lovely value enough for me. In my opinion, if all webmasters and bloggers made excellent content as you probably did, the internet will be much more useful than ever before.

Daftar dan login ke Kantorbola versi terbaru untuk pengalaman bermain bola online terbaik. Ikuti panduan lengkap kami untuk akses mudah, fitur unggulan, dan keamanan terjamin.

Great site. Lots of useful info here. I’m sending it to a few friends ans also sharing in delicious. And of course, thanks for your sweat!

Having read this I thought it was very informative. I appreciate you taking the time and effort to put this article together. I once again find myself spending way to much time both reading and commenting. But so what, it was still worth it!

Hi, Neat post. There is an issue together with your website in web explorer, may test this… IE nonetheless is the market leader and a huge component to people will leave out your fantastic writing because of this problem.

Hello very cool blog!! Guy .. Beautiful .. Amazing .. I’ll bookmark your website and take the feeds additionally…I’m satisfied to search out so many useful info here within the publish, we’d like work out extra techniques on this regard, thank you for sharing. . . . . .

I’ll right away seize your rss as I can not find your email subscription link or newsletter service. Do you have any? Kindly permit me understand in order that I may just subscribe. Thanks.

Hey! I’m at work surfing around your blog from my new iphone 3gs! Just wanted to say I love reading through your blog and look forward to all your posts! Keep up the fantastic work!

Great post. I am facing a couple of these problems.

I’ve read a few just right stuff here. Certainly worth bookmarking for revisiting. I surprise how so much effort you set to make the sort of excellent informative site.

I really appreciate this post. I have been looking all over for this! Thank goodness I found it on Bing. You’ve made my day! Thank you again

Greetings! Quick question that’s totally off topic. Do you know how to make your site mobile friendly? My web site looks weird when browsing from my iphone4. I’m trying to find a template or plugin that might be able to resolve this problem. If you have any recommendations, please share. Thanks!